🐝 Crypto Prices Skyrocket: Is the Bull Run Here?

Welcome to Web3 Buzz, your weekly newsletter providing the sweetest nectar for all your blockchain cravings.

Here's what's buzzing this week:

- Crypto Shock: Silicon Valley Bank Falls!

- Bull Run Finally Arrives? Crypto Prices Explode!

- Binance Flips $1B in Crypto, CZ Shakes Up the Market!

Crypto Prices Skyrocket: Is This the Bull Run We've Been Waiting For?

Yesterday was a wild ride! The crypto market was on fire, with prices soaring across the board. Even my web3 buzz wallet was in the green. Hell, I even added some veggies to my plate for dinner to keep the green going...

In total, the crypto market gained ~$70B. That's a lot of greenbacks!

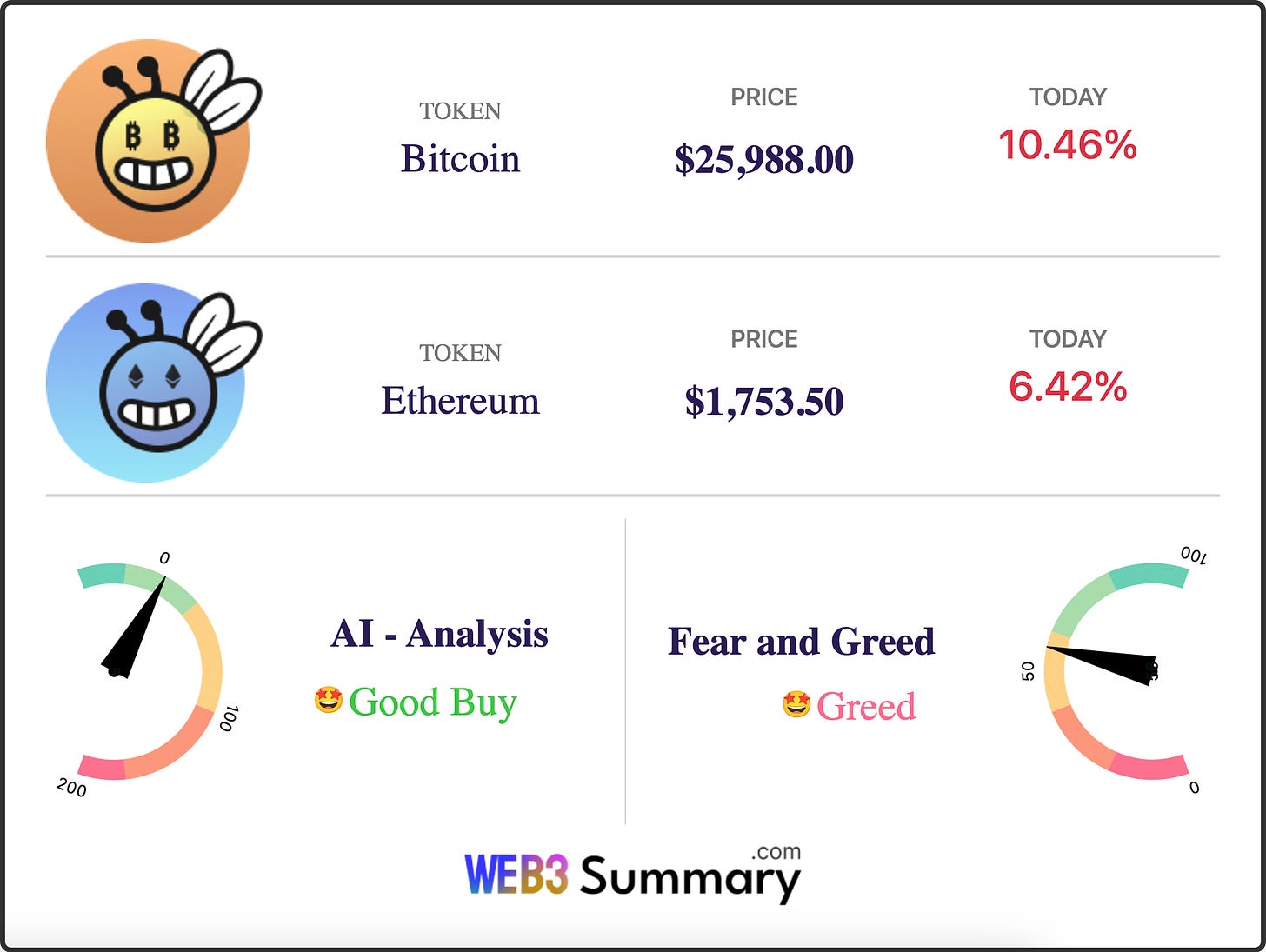

Bitcoin was the star of the show, up 9% on the day. Ether wasn't far behind, up 7%. And Cardano and Solana were the big winners, up 12% and 10.3%, respectively.

Why the optimism? Could be good ole confidence in decentralized assets like crypto after seeing banks fall. Could also be that the government is rescuing SVB and Signature depositors. But there’s also the rest of Binance’s $1B recovery fund that CZ just pumped into the market in the form of BTC, ETH, and BNB (Binance Coin.)

So, just for today's gain: Bitcoin touched $26,300 on Binance and Ethereum touched $1,780. That's some pump in a day!

Whatever the reason for the rally, at least crypto’s prices aren’t in the gutter like its banks are. It's a great time to be a crypto holder! Keep hodling and maybe one day we'll all retire on the moon! 🚀🌕

Silicon Valley Bank Collapses!

It all started with the collapse of Silicon Valley Bank (SVB), a prominent tech industry bank that had positioned itself as the go-to for startup founders. But then, they took some bad bets on rates and lost $80 billion in just 30 hours. Ouch.

This massive bank failure is the largest since the 2008 financial crisis, and it's causing ripple effects throughout the crypto world. Some crypto-focused firms, like Blockchain Capital and Pantera Capital, have lost access to their banking services, which is raising concerns about their ability to pay their employees and keep their businesses running during SVB's bankruptcy process.

On top of that, there's been a run on Signature Bank, with investors panicking and withdrawing their assets. Former representative Barney Frank, who was involved with the Signature Bank board, says regulators closed the bank to show that "crypto is toxic."

But not everyone is on board with that assessment. Frank actually supports new crypto regulations in the U.S. and emphasized that Signature Bank handled crypto "very carefully." He believes that banks should be strictly regulated with regard to crypto holdings, but doesn't think the recent events are indicative of a wider problem in the crypto world.

The International Monetary Fund (IMF), on the other hand, is warning G-20 nations that widespread adoption of crypto assets could lead to banks losing deposits and wider credit issues. It's a valid concern, but it's important to keep things in perspective.

Here at Web3 Buzz, we know that history might not repeat, but it sure as hell rhymes.

So, what does this mean for the future of crypto? It's hard to say for sure, but it's clear that we need to proceed with caution.

Think of it like this: SVB was like a massive tree in the forest of crypto, and its collapse has sent shockwaves throughout the entire ecosystem. But just because one tree falls, it doesn't mean the entire forest is doomed. In fact, this could be an opportunity for new growth and innovation to take root.

More possibilities lead to more cool sh*t being built, which in turn attracts more new users to the world of Web3.

It's a cycle that's been repeating itself for years, and there's no reason to think it won't continue.

So, keep your eyes on the crypto world and stay informed. And remember, just because things might look bleak right now, that doesn't mean the future isn't bright. In the words of HODLERS everywhere: "To the moon!"

Binance Flips $1B in Crypto, CZ Shakes Up the Market!

Binance just announced that they're going to convert $1 billion worth of BUSD stablecoin to Bitcoin, Ether, BNB, and other tokens. This move is set to support the market and help the crypto community recover from the recent blows it's been dealt.

Binance CEO Changpeng Zhao said in a tweet that the transaction from their industry fund to BUSD took only 5 seconds and cost a measly $1.29. That's faster and cheaper than a McDonald's drive-thru!

The move has already had a positive effect on the market, with Bitcoin jumping over $22,500 in Asian hours and Ether regaining the $1,600 market. Even BNB saw a surge of over 10%, reaching two-week highs.

But it's not all sunshine and rainbows in the crypto world. The crypto-friendly Signature Bank was just shut down by U.S. regulators, adding more stress to the already volatile market. And to top it off, Silvergate Bank was shut down just last week, followed by the collapse of Silicon Valley Bank on Friday night. Investors are in a frenzy, trying to protect their capital.

But with Binance's move, there's hope for a brighter future. Let's just hope the market can weather the storm and come out stronger on the other side.

⚡️ Daily 411: Get the Latest Must-Know News

Meta Announces Plans to Stop Working on NFTs (Link)

Bankless Enhances Web3 Push With New 2.0 Launch (Link)

Euler Suffers $200M Exploit in Flash Loan Attack (Link)

Facebook to Layoff another 10,000 Employees (Link)

Bitcoin derivatives suggest $26K resistance level won't hold for long (Link)

⚡️Buzzworthy Meme:

Follow us on Twitter to stay ahead of all the new updates @Web3summary

If your company is interested in reaching a crypto-savvy audience, you may want to advertise with us.

If you have any comments or feedback, just respond to this email!

How Do You Like Your Web3 Buzz Today?

🐝🐝🐝🐝 Out of this world!