🐝 Is Silvergate Bank the Next Crypto Domino to Fall?

Welcome Back, Let's Start with Monday Updates!

Good day, buzzing readers! This is Web3 Buzz, your honeycomb of all things crypto. We’re the sweetest spot to get your fix of the latest and greatest in the world of decentralized finance.

Here’s what we have in store for you:

The Fall of Silvergate Bank's Crypto Kingdom?

SEC Chair's Alarming Crypto Warning

SEC Drops the Hammer on Binance.US and Voyager Digital

Is Silvergate Bank's Crypto Empire Crumbling? The Ongoing Saga Continues...

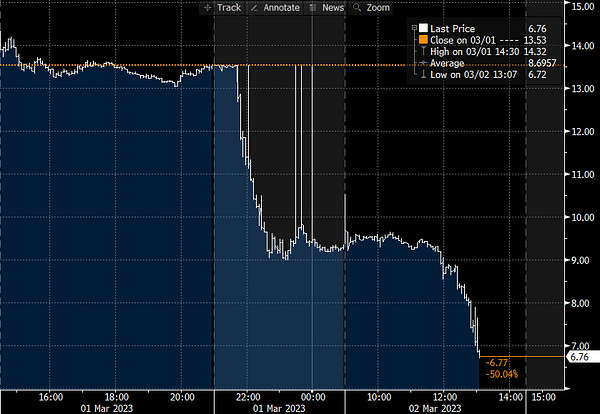

It looks like Silvergate might be the next domino to fall in the ongoing crypto saga. According to recent reports, the bank's stock price has taken a nosedive of about 60%, and things don't seem to be getting any better.

Silvergate has had a rough time of it lately, thanks to the crypto crash of 2022. It needs two extra weeks to assess the damage caused to its finances and to figure out if it can even continue operating for the next 12 months. Not exactly the kind of news you want to hear from your bank.

Silvergate has been one of the big players in the crypto world, and it handles around $11 billion in total assets. If you've used FTX, Binance, or Coinbase, then you've indirectly used Silvergate. The bank is a crucial "bridge" to crypto, with around 1,600 crypto clients that help about 80% of all funds flow into and out of the digital asset markets.

If Silvergate does fail, it could have a massive impact on the crypto markets. It could also deal a blow to established financial players like BlackRock, which has a large stake in the bank. It's a bit like a keystone in an arch - if it falls, everything else comes crashing down.

Investors have been withdrawing their funds from Silvergate, with $8.1 billion already pulled out after FTX, its client, blew up in November. To cover those withdrawn funds, the bank had to sell off debt at a $718 million loss. It's also revealed a $1 billion loss for Q4 and a $949 million loss for 2022 overall, compared to a $76 million profit for 2021.

But it's not just investors who are fleeing Silvergate. Coinbase, Galaxy Digital, Gemini, Circle, Crypto.com, and Paxos have already cut ties with the bank. And things are getting worse, with short sellers now targeting Silvergate's stock.

In the world of crypto, things move quickly, and it's not uncommon for companies to rise and fall just as fast. If Silvergate can't right the ship soon, it might become another cautionary tale for the industry.

So, what's the fallout from all this? Well, as they say, every cloud has a silver lining. Maybe this is an opportunity for new players to step up and take Silvergate's place. Or maybe it's a wake-up call for the crypto industry to take a hard look at the risks and challenges it faces. Only time will tell.

Is crypto safe on exchanges? Not so fast, says SEC Chair Gary Gensler

At an Investor Advisory Committee meeting on Thursday, Gensler pushed back on the notion that crypto exchanges could be trusted as qualified custodians for investment advisers.

Gensler praised a proposed rule that directs advisers to use qualified custodians for asset storage, including cryptocurrencies, as an "important enhancement" to existing protection rules. However, he cautioned against viewing crypto exchanges as safe under these guidelines.

"Based on how crypto trading and lending platforms generally operate, investment advisers cannot rely on them today as qualified custodians," Gensler stated. "To be clear: Just because a crypto trading platform claims to be a qualified custodian doesn’t mean that it is."

Gensler cited recent bankruptcies in the crypto industry, noting that customers' assets held on these platforms become part of the bankruptcy estate instead of returning directly to the customers.

"The expanded custody rule would help ensure that advisers don’t inappropriately use, abuse, or lose investors’ assets," Gensler added, referring to Congress's 2010 provision to expand the custody rule and granting the SEC new authorities to prevent another financial crisis like Bernie Madoff's frauds.

⚡️ Daily Sizzle: Today's Must-Know Topics

ETH Denver: DeFi gets snubbed while ZK, roll-ups, gaming, AI, and Asia steal the show. Looks like DeFi needs to work on its charisma game. (Link)

ERC-4337: The potential savior for crypto adoption goes unnoticed as everyone's too busy drooling over The Merge. Maybe it needs a catchy jingle to grab people's attention.

Uniswap wants to launch a mobile wallet, but Apple's putting on the brakes. Come on, Apple, don't be a party pooper. The wallet even has maximum security and all the bells and whistles.

Lido's LDO token takes a 10% nosedive thanks to a false rumor spread by a crypto podcaster. Oops, someone needs to fact-check their sources before hitting that tweet button.

SEC calls out Binance.US for running an unregistered securities exchange, while Voyager Digital is in hot water for violating federal securities laws. Looks like these guys need to take a crash course in SEC regulations before jumping into the crypto game.

⚡️Buzzworthy Memes:

Follow us on Twitter to stay ahead of all the new updates.

🐝 Ready to join our rapidly growing newsletter community?

Our subscribers are buzzing with excitement as we continue to experience explosive growth ⚡️, expanding 8 times every 2 weeks! By subscribing, you'll gain access to exclusive content and insights to stay ahead of the curve.

And for those looking to reach a highly engaged audience, our sponsorship opportunities are the perfect way to showcase your brand. Don't miss out on this sweet opportunity 🍯 - subscribe or sponsor us today and let's create something amazing together!"

How Do You Like Your Web3 Buzz Today?

🐝🐝🐝🐝 Out of this world!

Your Words Matter

SELECTED “ 🐝🐝🐝🐝 Out of this world!” : Awesome job on your newsletter "web3 buzz"! Your content is informative, engaging, and visually appealing. Keep up the great work!